In New Zealand, property has long been seen as a cornerstone of wealth — a safe, tangible investment that “always goes up.” But beneath this confidence lies a powerful psychological force that can distort decision-making: anchoring bias.

Anchoring occurs when we rely too heavily on an initial piece of information — such as a past purchase price, a cultural belief, or historical returns — and fail to adjust our thinking when circumstances change. In the context of property investment, this bias can lead to costly mistakes, missed opportunities, and unnecessary stress.

How Anchoring Shows Up in Property Investment

Anchoring to Historical Growth

Investors often assume that past capital gains will continue indefinitely, especially in high-growth areas like Auckland or Wellington. This belief can lead to overconfidence and underestimation of risk.Anchoring to Purchase Prices or Rental Yields

Many hold on to properties because they are emotionally or financially tied to what they paid or the rent they once received — even if the property is no longer performing well.Cultural Anchoring

In New Zealand, owning property is deeply embedded in our identity. This cultural anchor can make it difficult to consider alternative investment strategies, even when they may be more suitable for present and future needs such as in retirement or estate planning.

Market Conditions Are Changing

The RNZ Morning Report from 23 April 2025 highlighted growing challenges in the rental property market:

Rental listings have surged by 41% year-on-year, reaching levels not seen since 2014. This oversupply — driven by new builds and population shifts — has pushed the national median rent down 2.3% to $635 per week.

Some regions, like Taranaki, saw even steeper declines, while others like Nelson/Tasman and Otago experienced modest increases. Landlords are now offering incentives such as free rent or grocery vouchers to attract tenants.

Property investment coach Steve Goodey warns that many investors are struggling financially, with some properties sitting vacant for extended periods. The market has shifted in favour of renters, and landlords must now lower prices or risk significant losses.

Is Being a Landlord Really Investing — or Running a Business?

It’s important to recognise that owning rental property is not just an investment — it’s a business. And like any business, it comes with operational responsibilities, legal obligations, and exposure to risks that go far beyond market returns.

Landlords must manage tenants, maintain properties, comply with tenancy laws, and respond to unexpected events — from damage and disputes to vacancies and economic downturns. These are active responsibilities, not passive investments.

Higher Risk for Higher Reward — But Is the Reward Still There?

The traditional appeal of property investment has been the potential for capital growth and steady rental income. But in today’s market, that reward is far from guaranteed as we have seen:

Rental yields are under pressure, especially in oversupplied regions.

Vacancy rates are rising, forcing landlords to offer incentives or reduce rents.

Compliance costs have increased, with new healthy homes standards 1st July 2025, insurance requirements, and tax changes.[i]

Property values have flattened or declined in some areas, reducing capital gain potential.

When you factor in the time, stress, and financial risk involved, the risk-adjusted return of being a landlord may no longer stack up — especially when compared to more diversified, professionally managed alternatives.

A Real-World Example: When Property Becomes a Burden

A story shared by Alex, name changed for confidentiality reasons, illustrates just how emotionally and financially complex property investment can become:

Alex’s mother owns a rental property in a pleasant quiet country town. After initially renting to a tenant unknowingly associated with a local gang, she was misled by the tenant’s partner as the property soon became the crash pad and residence for a substantial number of people, and Alex had to go through the difficult process of removing them.

After fully renovating the home, a young family moved in — but tragically, the young husband took his own life in the house just a few weeks later. Now, the property is considered persona non grata in the community, and she faces a heartbreaking decision: sell a stigmatised property or evict a grieving young widow.

As Alex put it, “It’s the worst-case scenario of being a residential landlord” — and a sobering reminder of the emotional and reputational risks that can come with providing a roof over someone’s head.

In my earlier fire and general insurance career, I recall several claims for tenants along a similar line. Indeed, as well as evicting undesirable tenants sadly a suicide property as a trustee and property manager and property attorney in my fiduciary career. The key here is the chance of this occurring is small, even tiny, but the impact when it goes wrong as catastrophic and spectacular not in a clever way.

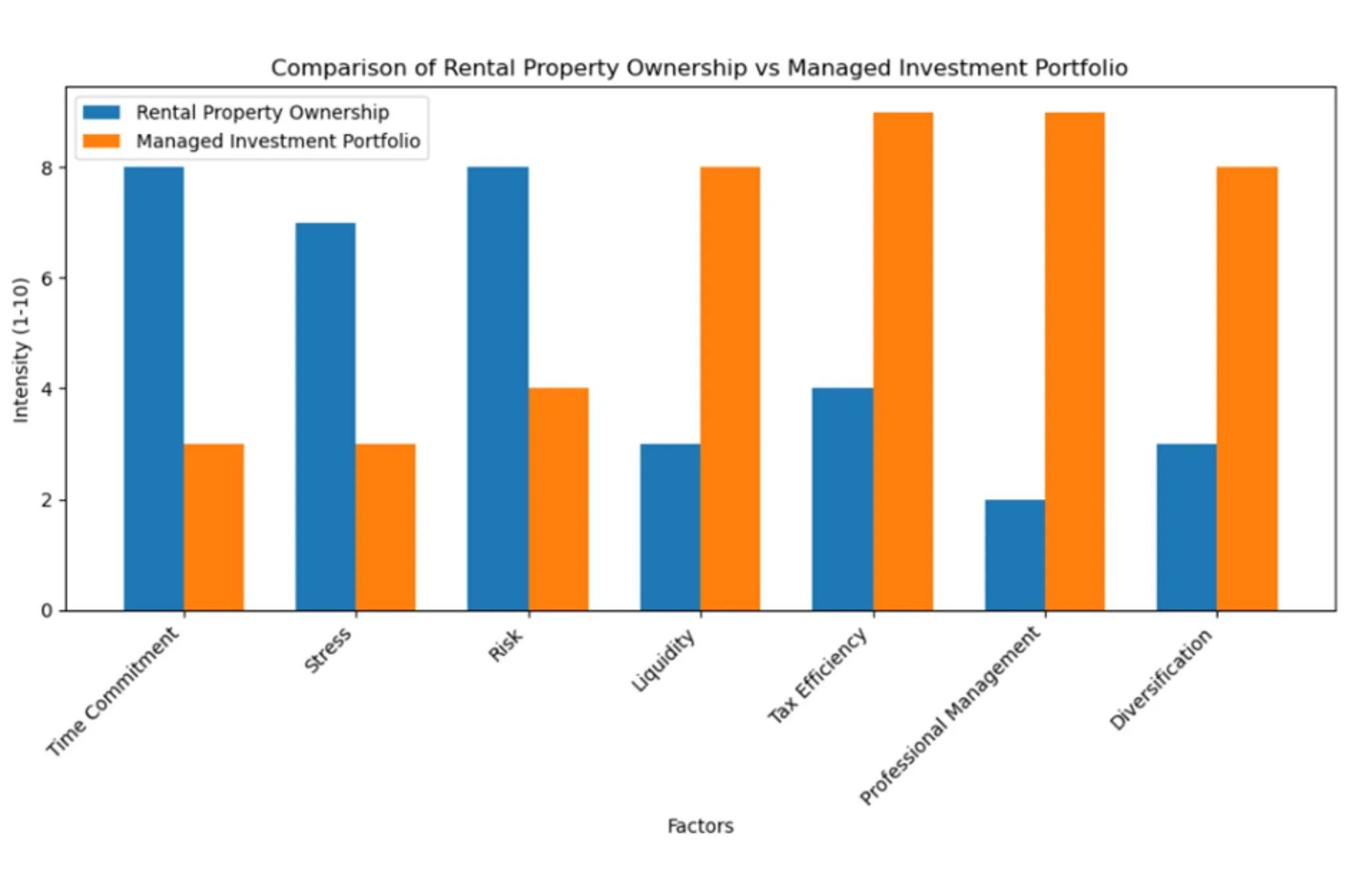

Here is how in my opinion we might see a comparison in rental property ownership to a bespoke portfolio

The Repercussions of Anchoring

Too Much in One Basket: Focusing on one asset (like property or shares) increases risk if that market drops.

Missed Diversification: Sticking to familiar investments can mean missing out on better or safer options.

Hard to Access Cash: Anchoring to illiquid assets can make it tough to get money when you need it.

Emotional & Reputation Risks: Holding onto poor investments out of pride can lead to bigger losses and damage your credibility.

Complicated Retirement: Relying too much on one income source can make retirement less stable and harder to manage.

The Role of a Certified Fiduciary Financial Adviser

One of the most effective ways to guard against anchoring bias — and other behavioural pitfalls — is to work with a Certified Fiduciary Financial Adviser.

Unlike traditional advisers, fiduciary advisers are legally and ethically bound to act in your best interest. Their role includes:

Challenging assumptions that may be rooted in outdated or emotional anchors

Providing objective analysis of your current investments and future goals

Helping you diversify beyond property into more flexible, tax-efficient options

Keeping your plan aligned with your values, lifestyle, and legacy intentions

Reducing complexity so you can focus on living well, not managing spreadsheets

By partnering with a fiduciary adviser, you gain a trusted guide who can help you make decisions based on what’s right for your future, not just what’s familiar from your past.

On a positive note.

I am helping clients effectively and efficiently shift from property-heavy portfolios to bespoke, liquid investment strategies tailored to their goals. These portfolios are grounded in evidence-based research and built through client centred financial planning and modelling, offering flexibility and alignment with their future needs.

Want to strengthen your financial future — for yourself and those you care about?

Discover how Stewart Financial Group could help anchor your goals, now and into the future.

Let’s have a conversation — no pressure, just clear personalised guidance.

[1] https://www.1news.co.nz/2025/07/01/deadline-passes-for-rental-standards-what-tenants-and-landlords-need-to-know/

Bruce Jenks is a financial adviser at Stewart Group, a Hawke’s Bay and Wellington-based CEFEX & BCorp certified financial planning and advisory firm. Stewart Group provides personal fiduciary services, wealth management, risk insurance and KiwiSaver scheme solutions. Blog No 19.

The information provided, or any opinions expressed in this article, are of a general nature only and should not be construed or relied on as a recommendation to invest in a financial product or class of financial products. You should seek financial advice specific to your circumstances from a Financial Adviser before making any financial decisions. A disclosure statement can be obtained free of charge by calling 0800 878 961 or visit our website, www.stewartgroup.co.nz