Source: Kiwi Bank

February 21, 2025

Key Developments

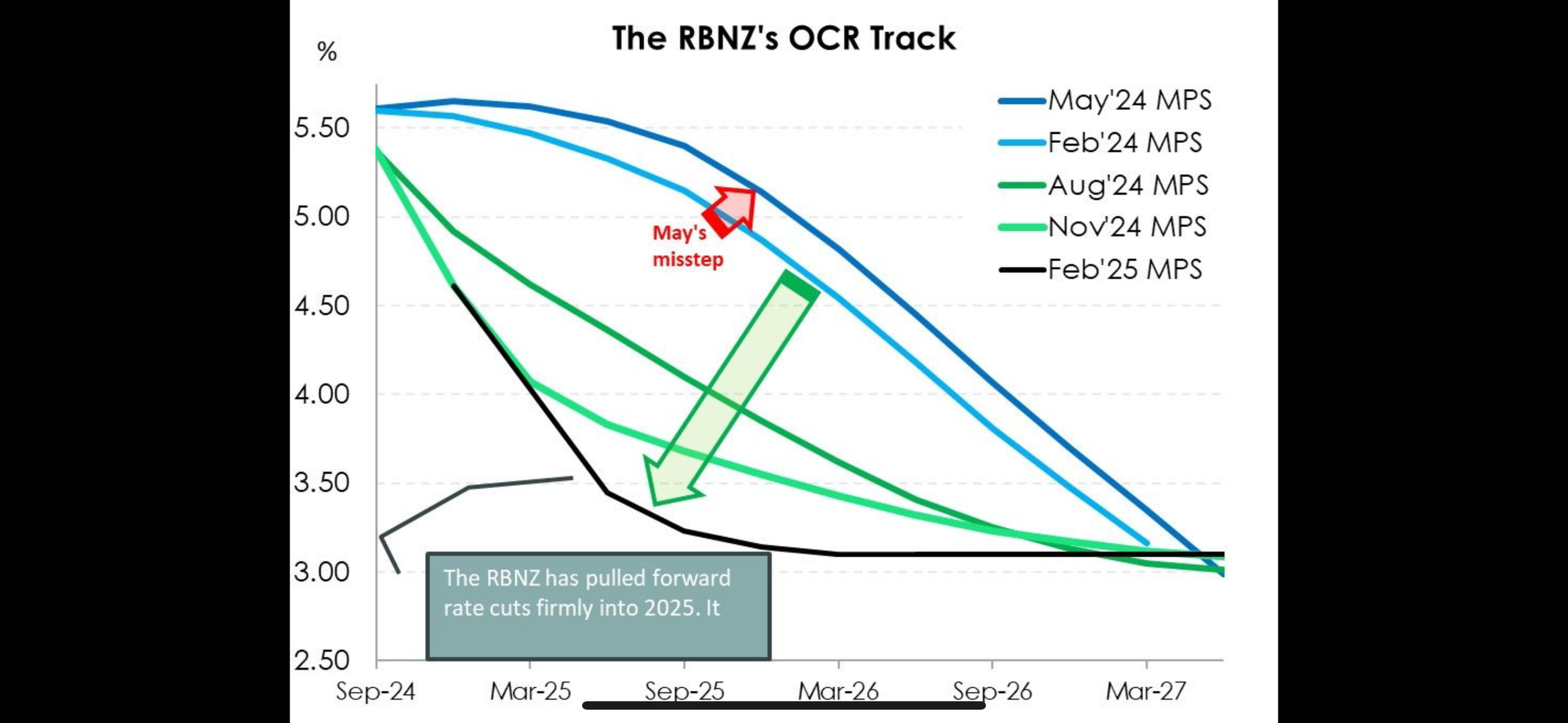

The Reserve Bank of New Zealand delivered the expected 50 basis point cut on Wednesday, acknowledging the economy's need for support. More significantly, they have lowered their Official Cash Rate (OCR) forecast track, signalling an accelerated easing cycle that aligns with market expectations and moves closer to our many economists 3% terminal rate projection.

Rate Path Forward (see chart)

April 2025: 25bp cut expected

May 2025: Additional 25bp cut to reach 3.25%

Beyond May: Gradual reduction to 3.1% through 2028 (effectively 3%)

Risk assessment: Downside risks predominate

Economic Context

The current 3.75% OCR remains restrictive, sitting above the neutral rate of approximately 3%. This restrictive stance is difficult to justify given:

Elevated unemployment

Inflation stabilised within target range

Economy emerging from recession

Positive Outlook

With inflation successfully managed, attention now shifts to economic recovery. The transmission of monetary policy should be relatively swift, as 81% of mortgages are fixed for less than one year. It is expected that the following will occur:

Economic recovery gaining momentum through 2025

Housing market strengthening all be it shallow

Stronger economic performance in 2026 compared to 2025

Forward View

The improving confidence indicators should translate into tangible economic benefits, including enhanced business activity, profitability, employment, and capital investment. Confidence in the recovery trajectory has strengthened considerably.

· Nick Stewart (Ngāi Tahu, Ngāti Huirapa, Ngāti Māmoe, Ngāti Waitaha) is a Financial Adviser and CEO at Stewart Group, a Hawke's Bay and Wellington based CEFEX & BCorp certified financial planning and advisory firm. Stewart Group provides personal fiduciary services, Wealth Management, Risk Insurance & KiwiSaver scheme solutions. Blog no. 3.

· The information provided, or any opinions expressed in this article, are of a general nature only and should not be construed or relied on as a recommendation to invest in a financial product or class of financial products. You should seek financial advice specific to your circumstances from a Financial Adviser before making any financial decisions. A disclosure statement can be obtained free of charge by calling 0800 878 961 or visit our website, www.stewartgroup.co.nz